5 hot tips for paying off debt - and still having a life

Jun 29, 2022

By Molly Benjamin - Founder of Ladies Finance Club

So, you want to get on top of your debts, but you also want to live your best life? It’s possible, we promise!

And you don’t have to do it alone. Our friends at WeMoney sat down and gave us the good oil on how to pay down debt without breaking a sweat.

1. Start small

Ultimately, it all comes down to spending less, so you can allocate that money to the very good cause of debt reduction. But it doesn’t have to be a huge chunk of money every week – even small but consistent payments can chip away at debt. Much like going on a diet, the key is not to deprive yourself so much that you give up. Find small savings that you can build on, and you’ll be much more likely to stay on track. Use the Goal Setting Section on the WeMoney budgeting app to keep it front and center.

Action: Set up a goal on WeMoney about how much you want to get out of debt and by when!

2. Plug the leaks

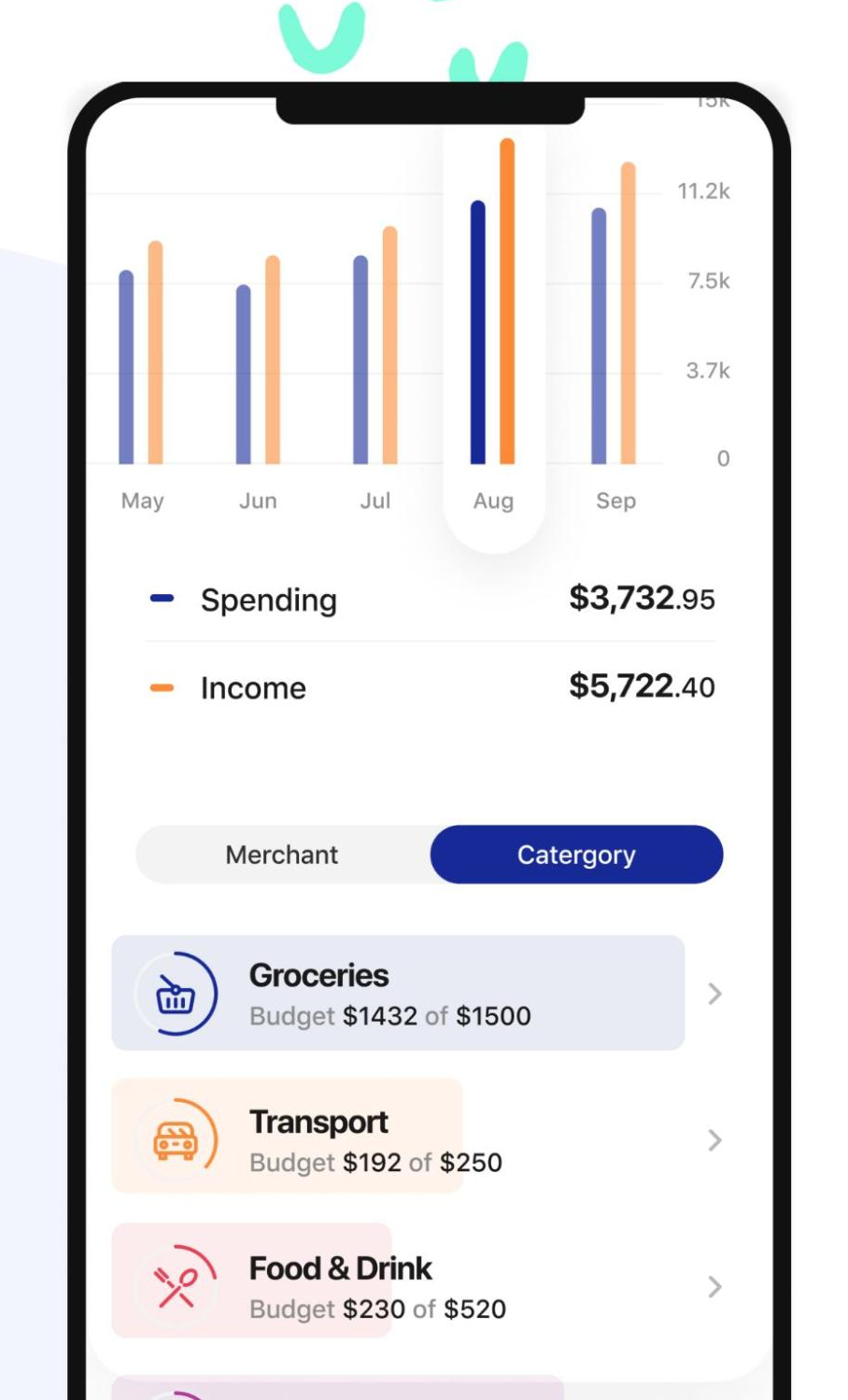

‘Where does all my money go?’. It’s a common question and everyone has their spending kryptonite. Maybe it’s too much food delivery, Friday night splurges at the bar (totally me), online shopping sprees or, trips to KiKi K (oops me again). The only way to be really honest with yourself - and your wallet - is to track your spending. WeMoney lets you see all your bank accounts (and other financial data) in one place, so you get way more visibility into where the leakages are, and which expenses could realistically be cut.

Action: Download WeMoney and track your spending every day for a month and see where you can cut back (ex: not using a subscription - cancel it).

3. Land a better deal

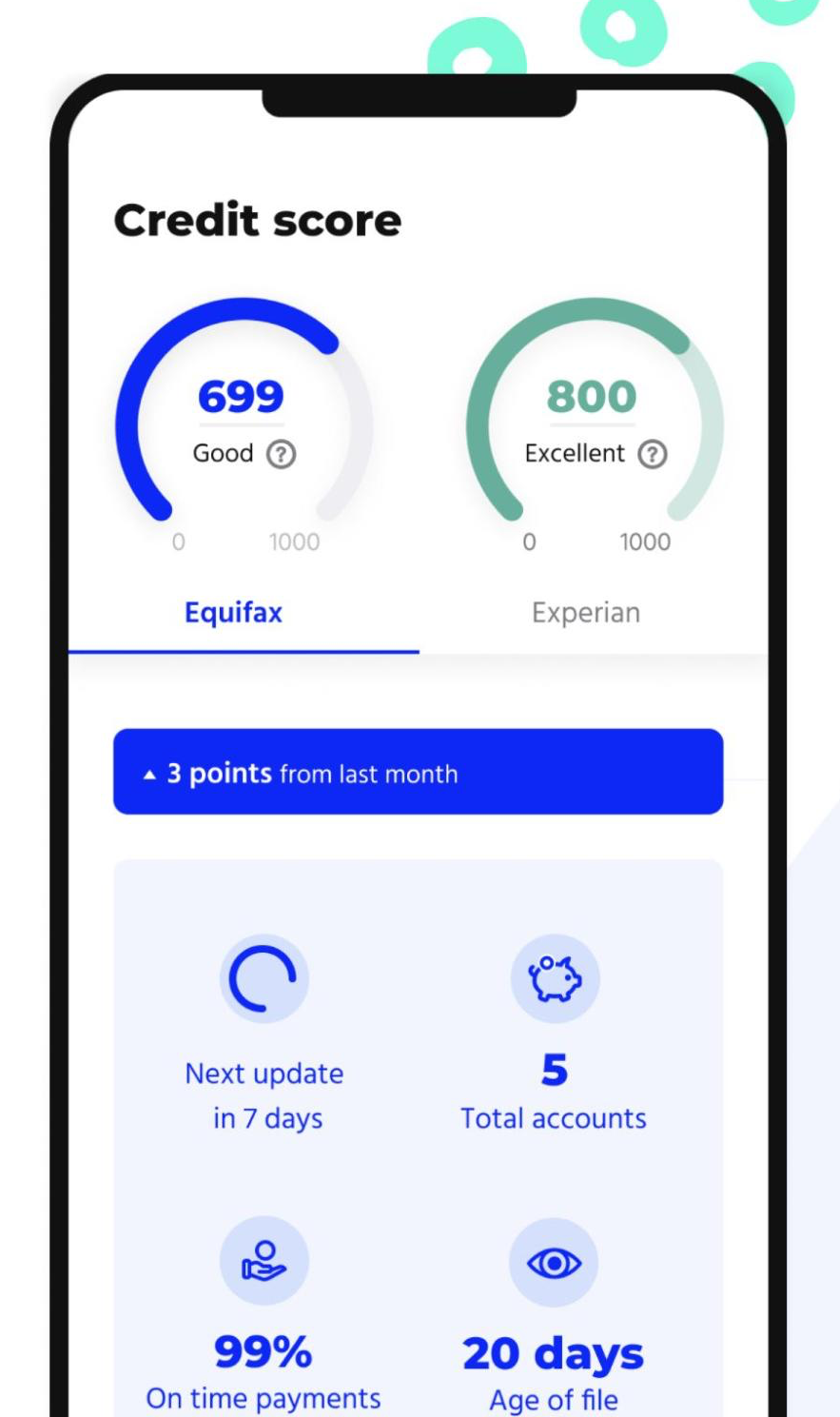

If you are on a debt-reduction-rampage, now is the perfect time to get ruthless with your money. No more paying loyalty taxes to insurers, lenders or utility companies who rely on you to not bother looking around. WeMoney can help you find better financial offers based on your profile and lets you compare a whole range of products so you can either negotiate a better deal with your current provider, or switch to one that saves you cash. Seriously, that money is much better in your pocket than theirs! You can also monitor and improve your credit score to see any changes happening over time (and nope, checking your credit score in WeMoney does not impact your credit score!)

Action: Check your credit score - is it good? If not find out why and make the changes necessary!

4. Channel your inner grandma

One of the best things about the older generations was their thriftiness. Whether it was using up food leftovers, mending things instead of replacing them, or buying second-hand – the generation that lived through world wars and depressions was very good at saving money. So, you can either ask the grandparents in your life for some tips, or you can tap into their mindset by hunting out budget-friendly recipes, googling how to fix things yourself, and using Facebook Marketplace as your new best friend.

Action: Is there something around the house you can sell right now (c’mon we all that that one dress we will never wear)? Pop it on Facebook Market, Depop or Ebay and turn it into chaching!

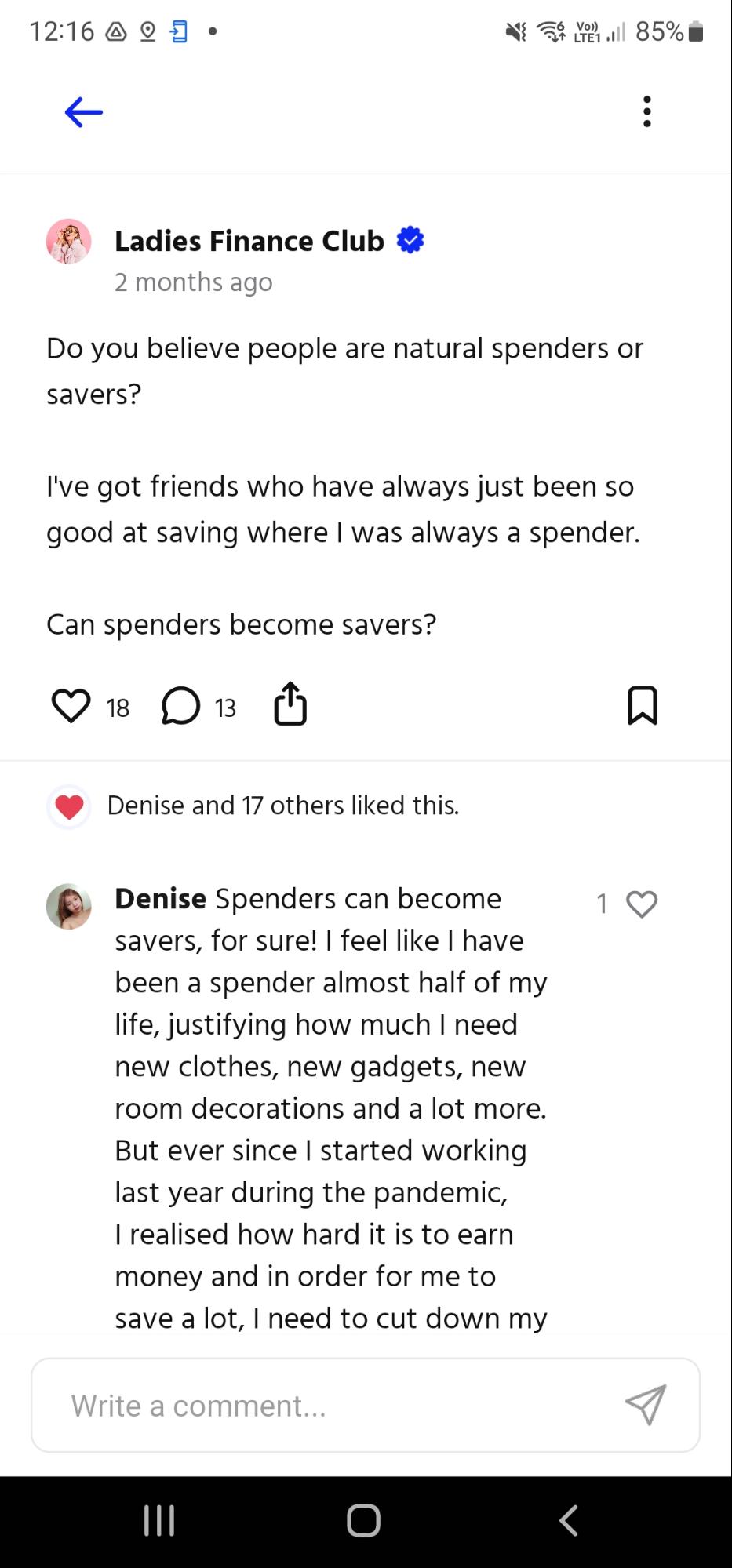

5. Find a cheer squad

Saving money is, let’s be honest, a bit of a grind. So why not find some support? You can join LFC’s accountability network or you can find the support of internet strangers – there is a keen community of like-minded souls on WeMoney who will enthusiastically cheer for you cutting $20 a month off your phone bill - they get it!

Action: Set up your profile on WeMoney Community and introduce yourself!

The key to all of this is facing your fears: don’t let debt be a constant worry, and don’t live in denial of your spending. Set aside some to sit down and get on top of it all, using an app like WeMoney to have all the info at your fingertips. The more you get to know your money, the more it will love you back!

Side note: For full transparency, this is a sponsored post however it's the app I (Molly) have been using for years to better manage my money and I fricken love it!