Here’s what the experts had to say about investing

Nov 08, 2021

We asked our experts to share their tips about investing..

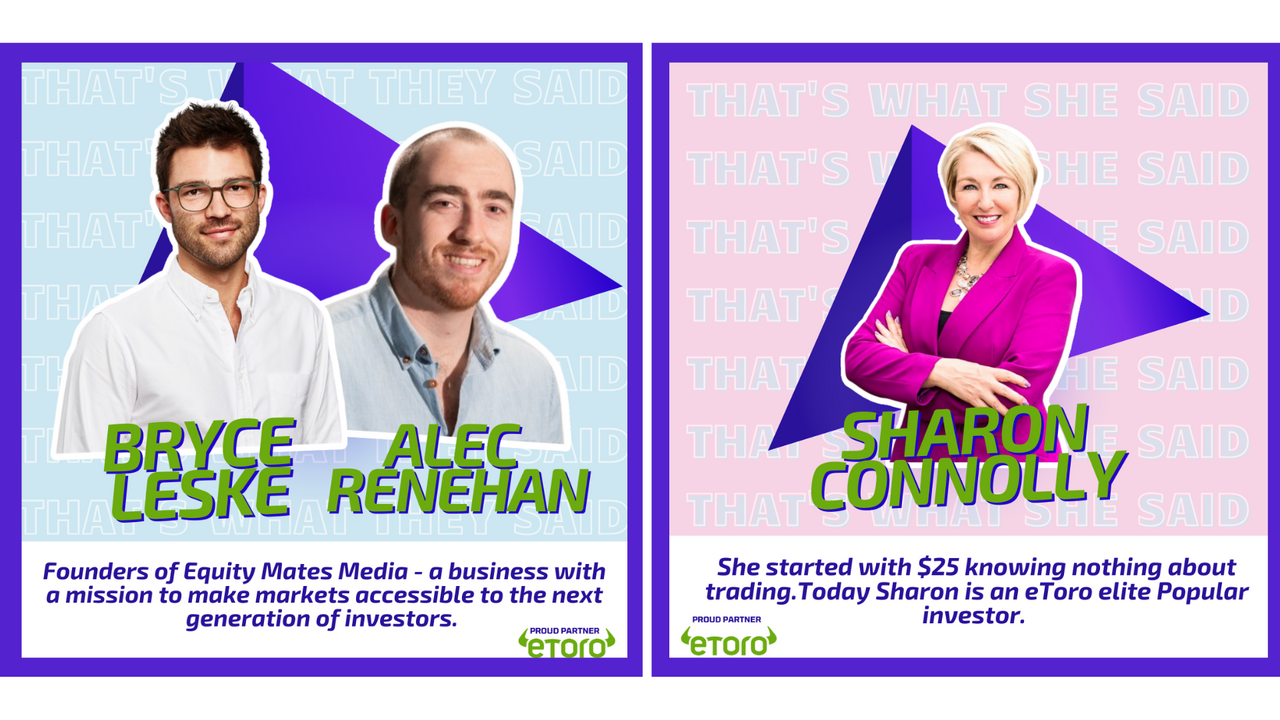

Sharon Connolly started her eToro investment journey with just $25 knowing nothing about trading. Today Sharon is an eToro elite Popular investor. One of only a handful of women traders with that status on eToro, worldwide. Tens of thousands of people follow and copy every move she makes on eToro. She’s gone from knowing nothing to having a diverse portfolio that consistently outperforms many of the top managed funds.

Top 3 favourite international companies you invest in and why?

My strategy is for growth, so these have to change. If you get stuck in a rut you’ll not be selecting the best stocks for growth.

The stock I have most of is Microsoft. Even though they’ve been around for a long time they continue to evolve, innovate and surprise.

Shopify is recent favourite – I have gained over 1000% since 2018.

Cloudflare is a recent acquisition. I think cyber security is a massive growth sector.

An investing mistake you have made and learned from?

FOMO. Don’t do it. Have a strategy and stick to it. BTC was going crazy in 2018. I was doubling, tripling and quadrupling small amounts so I thought I’d go all in and put 10K on cryptos. Not a good idea.

The best investment advice you ever got or heard?

Greed and fear are your worst enemies

Fave ESG friendly company?

I really wanted Beyond Beat to be fabulous. I stuck with it for a while, but it’s not doing much.

You r favourite ETF of all time?

I don’t generally invest in ETFs, preferring to cherry pick my investments. I do have a Vanguard property ETF and Spaceship account, but I like picking indiviuals on eToro best.

What do you look for in a company before investing?

What do they do. How do they treat their customers and employees (Snoop on LinkedIn). What is their Beta. I look at their revenue and see what market analysts are predicting.

Fundamental analysis is more important to me than technical analysis. If I’m not “wowed” by a company I don’t invest in them. I’ve ditched stocks before after getting terrible products or service from a company – like Marks and Spencers!

_________________________________________________________________________________

Co-founders of Equity mates Media, Bryce and Alec, met at university and both developed a passion for investing. As they spoke to friends and family about their interest, they realised a lot of people faced the same challenges. Financial markets were seen as complex and inaccessible and financial media catered to the industry but not every day Australians. Equity mates was created to break the world of investing, from beginning to dividend, to give everyday people the information, confidence and inspiration to start their own investing journeys.

Top 3 favourite international companies you invest in and why?

Spotify - we’re a media business, and we love audio. Spotify are leading the way in audio, and I believe they will continue to do so for a while.

Roblox - one of the most popular gaming platforms and game creation systems with over 164 million people playing each month; the forefront of the future of gaming.

AirBnb - name the last person that said ‘I used wotif.com to book’ - Airbnb is a dominant leader in accommodation booking, and with the works reopening, I anticipate it’ll start to regain a lot more user activity.

An investing mistake you have made and learned from?

I remember I sold one of my best performing stocks because some negative news came out about it and the share price started to quickly fall. As always, it turned out that the market overreacted to the news and it recovered to a price above what I sold it for. The lesson: don’t react to daily noise, be focussed on your investment thesis and stay calm

The best investment advice you ever got or heard?

Start as early as possible. Almost every expert we’ve spoken to has said this. The power of compounding and being in the markets as long as possible is incredible. Start now!

Fave ESG friendly company?

This might be a little controversial but I’d say it’s BlackRock. They’re one of the largest asset managers in the world, and have made a very public decision to focus their business on sustainability. Money talks, and it helps to have their trillions of dollars pointed in the right direction.

Your favourite ETF of all time?

I have two: GEAR and GGUS - both are leveraged ETFs, with GEAR tracking the Aussie market, and GGUS the US. Simple but effective over a long period.