6 investment platforms we likey!

Oct 04, 2021

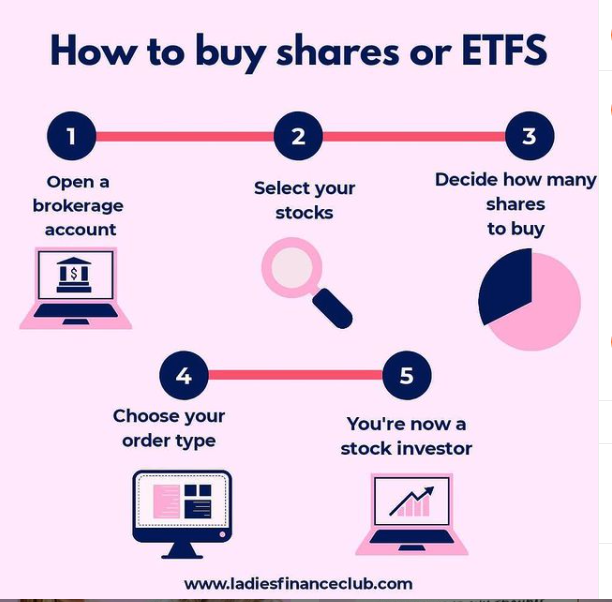

So you have decided you want to start investing in buying shares or ETFs (Exchange Traded Funds). Welcome to the club! Investing has never been so accessible - no longer do you need to be waving papers down on the stockmarket floor – you can become an investor in minutes all from your mobile phone! As we say at LFC if you can online shop you can buy shares online! Here at LFC one of our content gals Melissa has done the research and compiled a list of six of our favourite share trading products to help you work out the best option for you. Remember to always do your own research and ask questions to understand exactly what each product does and if it is the right fit for you.

Remember, before you starting investing check these three things:

1. You don't have any high-interest debt (credit card, BYPL)

2. You have an emergency fund in cash (at least 3 month's worth of expenses)

3. You don't need that money in the next 3-5 years (we want to let compounding returns do its thing and not interrupt it)! You got this lady!

What is it?

Pearler is the new kid on the block and is a low-cost trading platform. It was founded in 2018 by three Sydney dudes who wanted to make investing easy and accessible for the next wave of investors. Pearler differentiates itself as an online brokering platform that is helping Aussies achieve financial independence via long-term investing (and we are all about the long term). The owners have an interest and affiliation with the FIRE (financial independence, retire early) community. Need some inspiration? You can follow the investing journeys of finfluencers to educate you or to help you stay on track and if you are not sure where to start with your investment portfolio, you can use pearler template portfolios as your starting point.

Why we likey:

Everything can be done on your phone! We like that it’s low-cost with no hidden fees. There is an opportunity for free brokerage on 46 select ETF’s with the list still growing (as long as you don’t sell in the first year). Pearler is CHESS sponsored meaning that shares held with pearler are as safe as shares held with Commsec, NABtrade, or any other big Australian broker – and that’s because you own your shares directly. Pearler has recently added the ability to purchase US shares so it’s great for those investors who want to build their portfolios internationally. Tesla shares anyone?! They also have a great auto-invest feature which means you can be investing literally while you sleep!

How much is it? Pearler is a simple-to-use pay-per-trade system with no extra fees. Presently, Australian trades are a flat $9.50 per trade while US trades are $6.50. There is no minimum to start trading. Once you open your account, you can start trading with any amount you like.

LFC founder Molly created a video with Ana from their team on how to use the platform! Check it out here.

- Superhero

What is it?

Superhero is a share trading platform with a couple of very attractive features plus a little extra twist! Customers can trade stocks and shares on the ASX and the US. Recently, Superhero introduced a feature in which you can opt to control your superannuation directly without needing to set up a costly self-managed super fund.

Why we likey:

Superhero is one of the newer fintech brokers to be introduced to the Australian investment market in late 2020. It shook things up by charging zero brokerage to purchase ETF’s and a small $5 brokerage fee for all 2500+ Australian stocks. It really is one of the cheapest brokerage platforms available today - The small start-up investment of $100 is perfect for beginning investors as well. Other cool tools include a share trading wallet to keep tabs on your cash flow and users also get a handy reports feature which will help you track your performance like the pro’s do! This is all available on the app which is perfect for those women on the go. Superhero delivers an accessible, easy to understand and affordable product which makes investing an easy and interesting journey.

How much is it? Open an account with a minimum $100 and start investing with $5 flat fee on ASX share trades and $0 brokerage on US share trades. LFC members can watch a video on how to use this platform in our LFC member's hub!

- nabtrade

What is it?

With one account, customers can invest directly in a range of products including domestic and international shares, ETF's, bonds and more and no, you don’t need to be a NAB customer to use the nabtrade platform.

The online trading platform is pretty comprehensive with loads of financial information and reporting. There is a tiered service level tailored to the trading activity of the user.

Why we likey?

It is a little more complicated than the apps above but you can do a lot of it. While nabtrade offers tools for both new traders and the more experienced, it is very comprehensive share trading platform that offers strong research-based analysis. This could be a little overwhelming to people starting out in investing but there is support available for those who are learning the way. nabtrade has a wide range of available markets including ASX (Australia), NASDAQ (US), NYSE(US), London Stock Exchange, AMEX (US), Hong Kong Stock Exchange.

How much is it? Open an account with a minimum $100 and start investing with $14.95 brokerage fee up to $5000 on ASX and international trades. For trades $5000 - $20 000, the brokerage fee is $19.95.

- CommSec

What is it?

CommSec is still the biggest broker in Australia. It’s the largest, and most trusted stockbroker in Australia. The platform has a bunch of features such as online education and active online community discussion group. Its big bank reputation (Commonwealth Bank) ensures customers feel safe using the platform. It is predominantly designed for investors and traders who are already familiar with how share trading platforms work. New traders can still get involved as there are a range of account types you can choose to create when you open a CommSec trading account. As an example, one type of account is the CommSec Pocket. This one is great for those who are new to the market. It allows trade to seven different ETF’s ranging from top 200 Australian companies to emerging markets in fast-growing global economies. If you are more of a seasoned trader, you can go with CommSec One which is designed for active traders who spend more than $3000 in annual brokerage. This account includes a dedicated customer service team and free additional research, access and trading tools.

Why we likey?

CommSec is one of the most established share trading platforms having started in 1995. It is used by the majority of all investors (and traders) in Australia, with a huge 55% market share – the other banks make up most of the rest, followed up by a small share provided by the newer fintech companies. The CommSe app is great for mobile devices and allows for full trading. There is a range of investment options including Australian and international shares, as well as other more financial products across personal, joint, trust, corporate and even Self Managed Super Funds (SMSF) accounts. And if it is important to you, CommSec is fully CHESS sponsored which means they issue you an individual Holder Identification Number (HIN) and your shares are registered with the Clearing House Electronic Subregister System (CHESS) on the Australian Securities Exchange (ASX).e

How much is it?

CommSec Pocket.

- $2.00 for trades up to and including $1,000

- 0.20% of the value of trades above $1,000

- You can start investing with as little as $50 but you have to be a Commsec customer!

CommSec

- $10.00 (Up to and including $1,000)

- $19.95 (Over $1,000 up to $10,000 (inclusive))

- $29.95 (Over $10,000 up to $25,000 (inclusive))

- 0.12% (Over $25,000)

- For international shares, it starts at $19.95 for trades up to USD $5,000.

SelfWealth

What is it?

SelfWealth is another low-cost platform to access both Australian and US markets. More experienced investors get some extra goodies for a monthly fee while newbies can follow what successful investors are doing and copy them in a 90-day trial. It has a flat-fee pricing structure which is appealing to those who are planning higher-value trades and wish to avoid fees that are calculated as a percentage of the traded amount.

Why we likey?

SelfWealth accounts can be opened by individuals (or groups of up to three individuals in a joint account), companies and trusts. As a little added bonus, SelfWealth have made it possible for kids to have their own trading accounts as well. An adult can open the share trading account as the trustee and the child as the beneficiary. This is a great feature to build a nest egg or teach your kids the importance of having financial goals and saving for the future. When the child turns 18, shares that are held in the trustee account are transferred into their own name.

Tech-wise, SelfWealth Australia has produced an exceptional platform for the cost of one of the lowest fee online brokerages in Australia. The platform has an excellent community benchmarking tool to gauge your performance against others on the platform and incorporates one of the best mobile apps currently on offer. The SelfWealth community is dynamic and very interactive. This is an awesome feature that helps to provide support and further educate new investors.

Once again, if it is something of importance to you, SelfWealth holds funds under an individual’s HIN number and is CHESS Sponsored.

How much is it?

You can open an account for free and get started trading with $500. Each trade is $9.50 per trade regardless of trade size (be aware however, US trade fees are charged in USD). There are no other hidden or inactivity fees from SelfWealth. For International shares, they charge 0.60% on the bid/ask spread for moving money between your AUD and USD accounts.

ETORO

What is it?

eToro is one of the world's biggest social trading and investment platform they have millions of users around the globe. FYI you can't buy any ASX listed companies on Etoro yet but apparently, this coming in 2022. There are also no limits on commission-free trades and you can buy fractional shares (for example can't afford a whole Tesla share buy a percentage of it).

Why we likey?

They have technology that allows you to automatically copy other Pro traders portfolio performance. They have millions of users from over 140 countries who trade with eToro. If cryptocurrency is your thing you can also trade that via their platform.

How much?

For Aussies, only stocks traded on US stock exchanges are available to trade with no commission. Crypto have their own fees and it's a little complicated so do your research! Example - eToro Typical Spread for BTC:0.75%