How to Start Investing

Nov 23, 2022

Brought to you by Sharesies

Keen to invest but not sure where to begin? Here are some handy tips courtesy of our friends at Sharesies. Use promo code PINEAPPLE and get $10 in your account, ready to invest. T&Cs apply.

First up, some things to do

Here we share some things to tick off your list before you take the investing plunge. They’re a mix of things you know and some that involve a little research.

Know what you have to choose from

Understanding the difference between investing in companies or exchange-traded funds (ETFs) is a stellar place to start. You can invest in one or more companies or ETFs. ETFs can invest in a spread of company shares, bonds, property, or a specific theme, trend, or sector. On the Sharesies platform, you can do both, so don’t let deciding on one or the other stop you from getting started.

Assess your risk appetite

Think about what your risk appetite is now, and be aware it can change—particularly in times of volatility or when your personal circumstances shift. While higher-risk investments may result in more significant returns, choosing lower-risk options may provide more consistency over the long term. Either way, only you can decide how much risk you’ll feel good about and what your financial situation allows—so know this upfront and reassess regularly.

Get clear on your investing goals

What you want to get from your investing journey doesn’t have to be just one thing. You may want to invest for a short-term goal, like travel or a car—or a longer-term goal like retirement. You can have an investing strategy for both. If there’s money you need access to sooner rather than later, that’s ok! It doesn’t mean you can’t have a portion of your Portfolio dedicated to the long haul in the meantime.

Select a strategy

It helps when getting started to have an investing strategy in mind. That way, you’re less likely to be reactive in your approach. One investing strategy is dollar-cost averaging. Essentially, it helps you average out the ups and downs of the market over time. So when prices are high, you’ll buy fewer shares, and when prices are low, you’ll buy more. It’s one way to keep up a regular and consistent investing habit, despite market fluctuations. There’s a way to automate this too. More on that later …

Secondly, some things to steer clear of

Common pitfalls can hamper your foray into investing. Here are some things to avoid as you begin your journey.

Having too many eggs in one basket

While it can be tempting to go all-in on an investment that’s currently performing well, it exposes you to a higher risk level if it takes a hit. Be sure to have a good understanding of diversification and how a diversified Portfolio can help shield you from things outside of your control.

Selling too much, too soon

A common mistake first-time investors make is to cash out all of their returns as soon as things start to increase in value. This may be the right approach for your strategy or financial needs at the time, but you could also limit potential future gains. Avoid this pitfall by having a plan for any returns before you see them in your Portfolio.

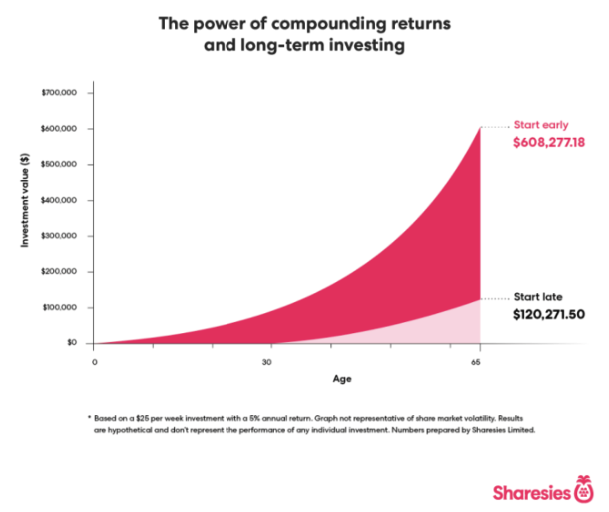

Thinking that small amounts don’t count

It’s been a long-held assumption that you need to have a lot of money to invest, and this misconception means that many never take the leap. While having a tidy lump sum to dedicate to investing isn’t a negative, waiting until you have one can be. Particularly when the benefits of compounding returns come into play.

Time in the market beats timing the market. Starting out with a little or investing small amounts regularly can make a difference and help you learn. Speaking of …

Thirdly, selecting a sum and a schedule

Many people get stuck when choosing how much and how often to invest. Only you know what feels right for you, but aim to make it affordable and sustainable. Here’s how you might conquer this final common hurdle!

Pledge to invest unexpected income

Investing extra amounts like a bump up in pay, birthday money, or a bonus means you could give your Portfolio a boost, without noticing any impact on your daily life—or missing out on that meal!.

Pick a percentage

This one is handy if your pay varies each week, fortnight, or month because even if what you have coming in changes, the percentage you dedicate to investing can stay the same.

Invest the easy way

Auto-invest on the Sharesies platform lets you pick an order and the amount you want to regularly invest, and it’ll place the orders for you. It’s a handy option to keep your investing goals in sight.

Get growing!

Don’t let being a beginner stop you from beginning. Every investor started somewhere! Your knowledge and confidence will grow as you go—so jump on in and kickstart your investing journey. You can start investing on the Sharesies platform today, with over 8,000 options across the AU, US, and NZ share markets and no minimum investment to get started. Use promo code PINEAPPLE and get $10 in your account, ready to invest. T&Cs apply.

All investing involves risk. T&Cs and fees apply for use of the platform provided by Sharesies Limited. $10 applies to new accounts only. Promotion T&Cs apply and for use of the platform provided by Sharesies Limited. This article has been provided by Sharesies AU Pty Ltd as a Corporate Authorised Representative of Sanlam Private Wealth Pty Ltd (AFSL No. 337927)