How to get started with investing

Nov 07, 2022

Brought to you by Pearler

Getting started with investing can feel a bit daunting. It doesn’t help that the internet is awash with conflicting advice, investing dudebros, and often toxic finance forums. That’s why we’re to provide a simple, no-fuss guide for how to get started with investing. Welcome to the New You, finance queens!

- There are some people who go out of their way to make investing feel unapproachable. However, it’s never been easier to start building wealth.

- Before you start investing, there are a few key steps you should take.

- If you’re not sure how to approach the share market, micro-investing can be a sensible place to start. This article will walk you through how to get started.

- Once you’re familiar with the broad strokes of investing, you’ll have a range of wealth-building options at your fingertips.

Stop us if this sounds familiar. You’ve heard from a few trusted sources that you should get into investing. Not sure where to begin, you Google “how to get started with investing”. The first result you visit? A website in which a middle-aged guy in a $10,000 suit mansplains investing with a series of graphs. The second? A Reddit forum in which a bunch of dudes share in-jokes and queasy memes. The third appears to be a “comparison” site, but you have a sneaking suspicion you’re looking at a glorified billboard.

None of these are particularly helpful. And - worst of all - all of them seem to offer conflicting advice.

As you might suspect, this is by design. A small but loud offshoot of the investing community acts as gatekeepers online. They try to deter new players from encroaching on what they’ve deemed their turf - and yes, they’re usually guys. Then you have the reps of Big Finance, who labour to make investing seem more complicated than it really is. They do this because they make more money when your money sits in a bank account.

Unfortunately for both groups, it’s never been easier to start investing. And, without further ado, we’re here to show you how to become a confident long term investor!

Things to do before you invest

Before you start building that wealth, there are a few other financial goals you should crush. Namely, you’ll want to pay off all your bad debts first. By “bad debt”, we mean credit you owe for anything that isn’t likely to increase in value. Specifically, personal loans, Buy Now Pay Later, or credit cards have historically accrued interest faster than most stable investments have earned a return.

To put this numerically, you can generally expect to pay between 10% - 25% pa interest after tax on bad debts. In contrast, major share markets in countries like Australia have historically returned an average of between 5% - 10% p.a. If these figures play out, you could potentially find a 20% gap between what you’re earning and what you’re paying. For this reason, it makes sense to pay off your bad debts in full before you invest a cent. For more details on debt, check out our article: “how to retire with $1 million”.

How to get started with investing by starting small

Now that you’ve fired that bad debt from your life, you can start investing. For many people who have never traded on the share market, this is where their eyes glaze over. Fortunately, there now exist an array of options for people who don’t want to overcomplicate or invest too much. And if you’re looking to start small, micro-investing can be a sensible choice. That’s why, in this article, we’ll be focusing on micro-investing platforms.

Typically, traditional share investing platforms require you to get invest amounts of at least $500 or more. With micro-investing platforms, you can start investing with as little as $5. What’s more, you can spread that $5 investment across hundreds or even thousands of shares. You might not think that a single $5 investment would take you very far - and, historically speaking, you’d be right. However, by regularly making small contributions, your $5 can grow into a hefty portfolio faster than you might imagine.

Now that we’ve covered the fundamentals, we’ll give you a simple, step-by-step guide for setting up your investments. For our example, we’ll use the micro-investing platform Pearler Micro (full disclosure: we’re part of the team at Pearler, so it would be strange if we used any other example!).

Step 1

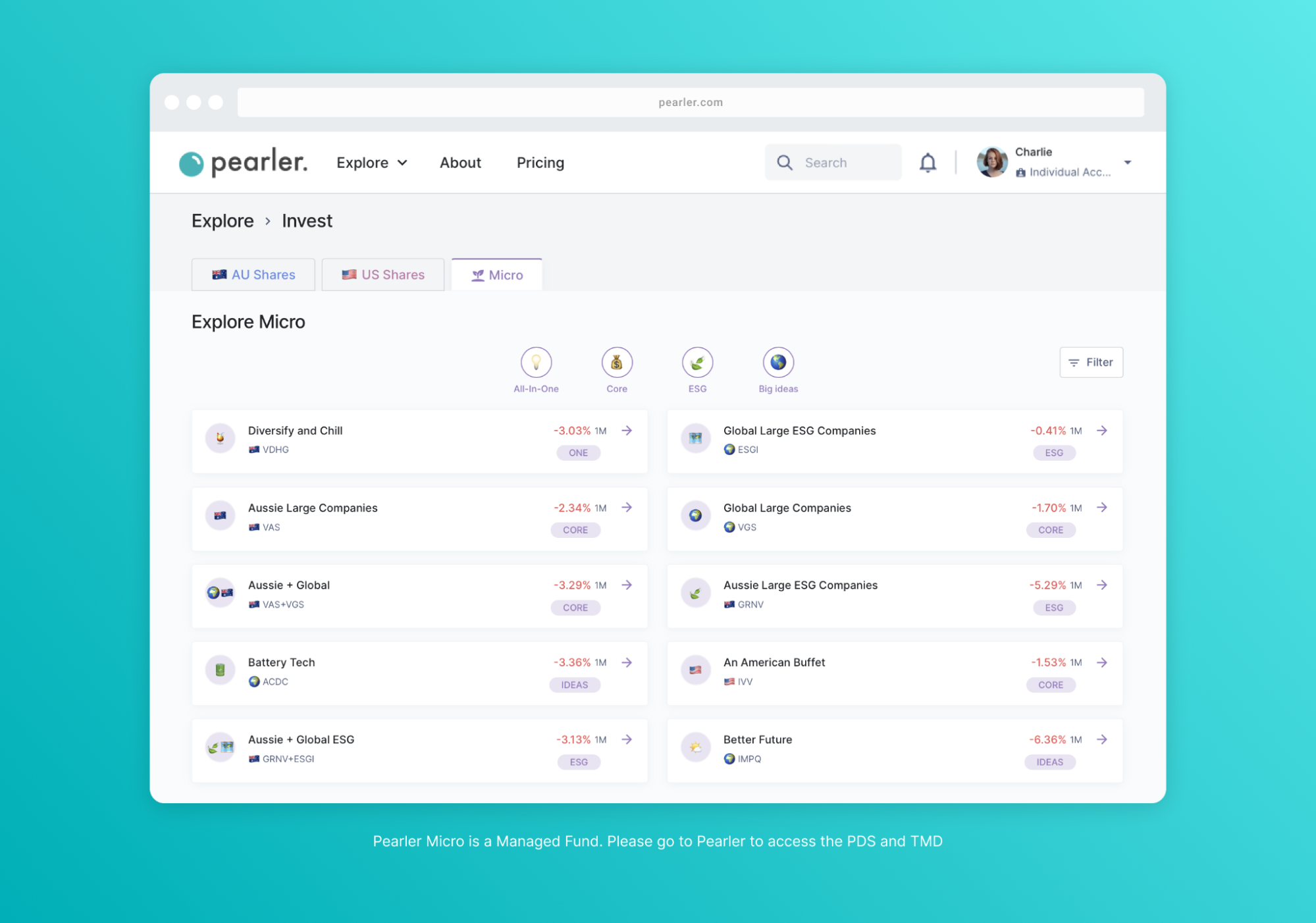

Begin by signing up for a Pearler Micro account. Once your account is live, you can choose from one of 10 investing options. If you’re stuck, we recommend either Diversify and Chill, Aussie + Global, or Aussie + Global ESG to get started.

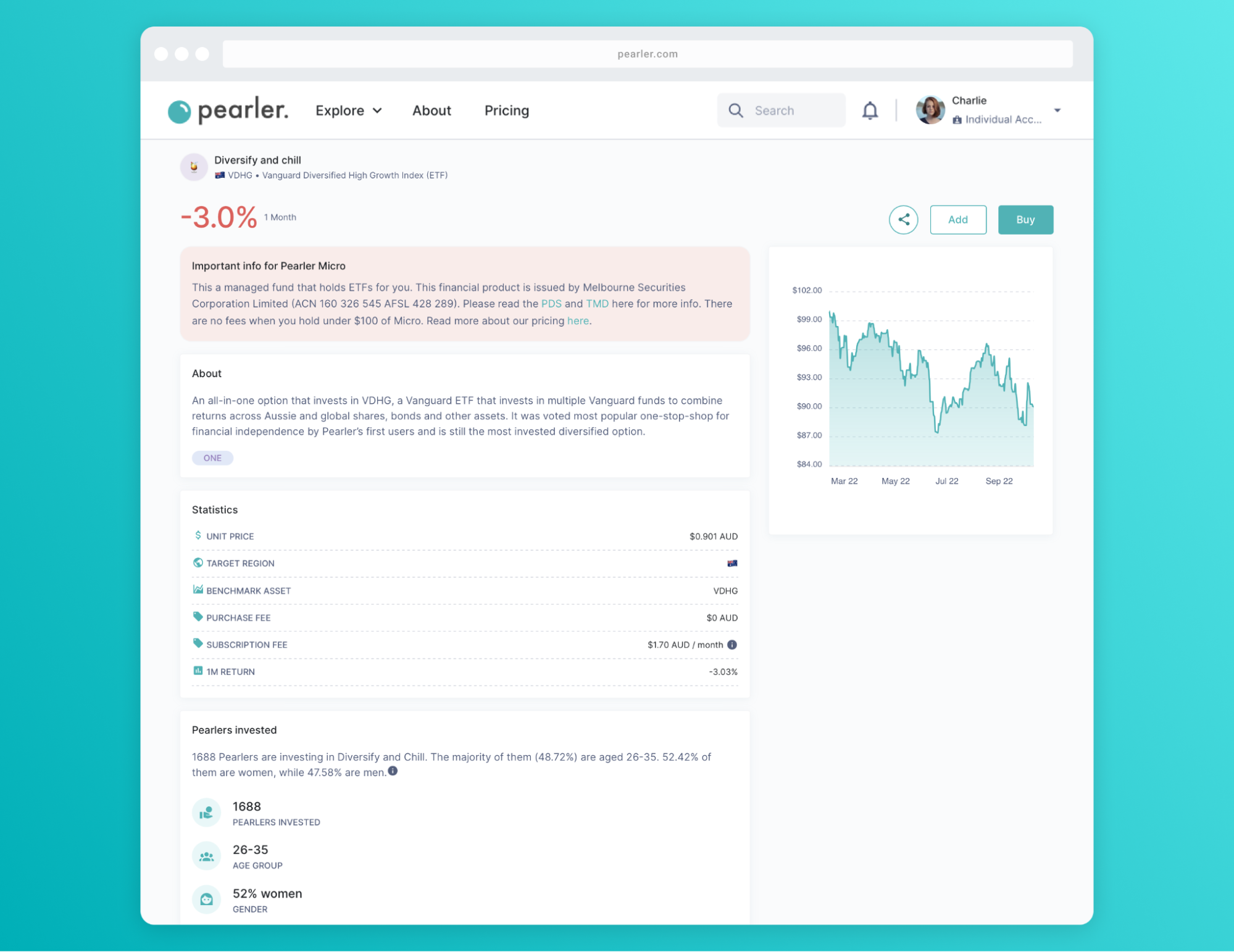

Here you can see some statistics about the different investment options.

Step 2

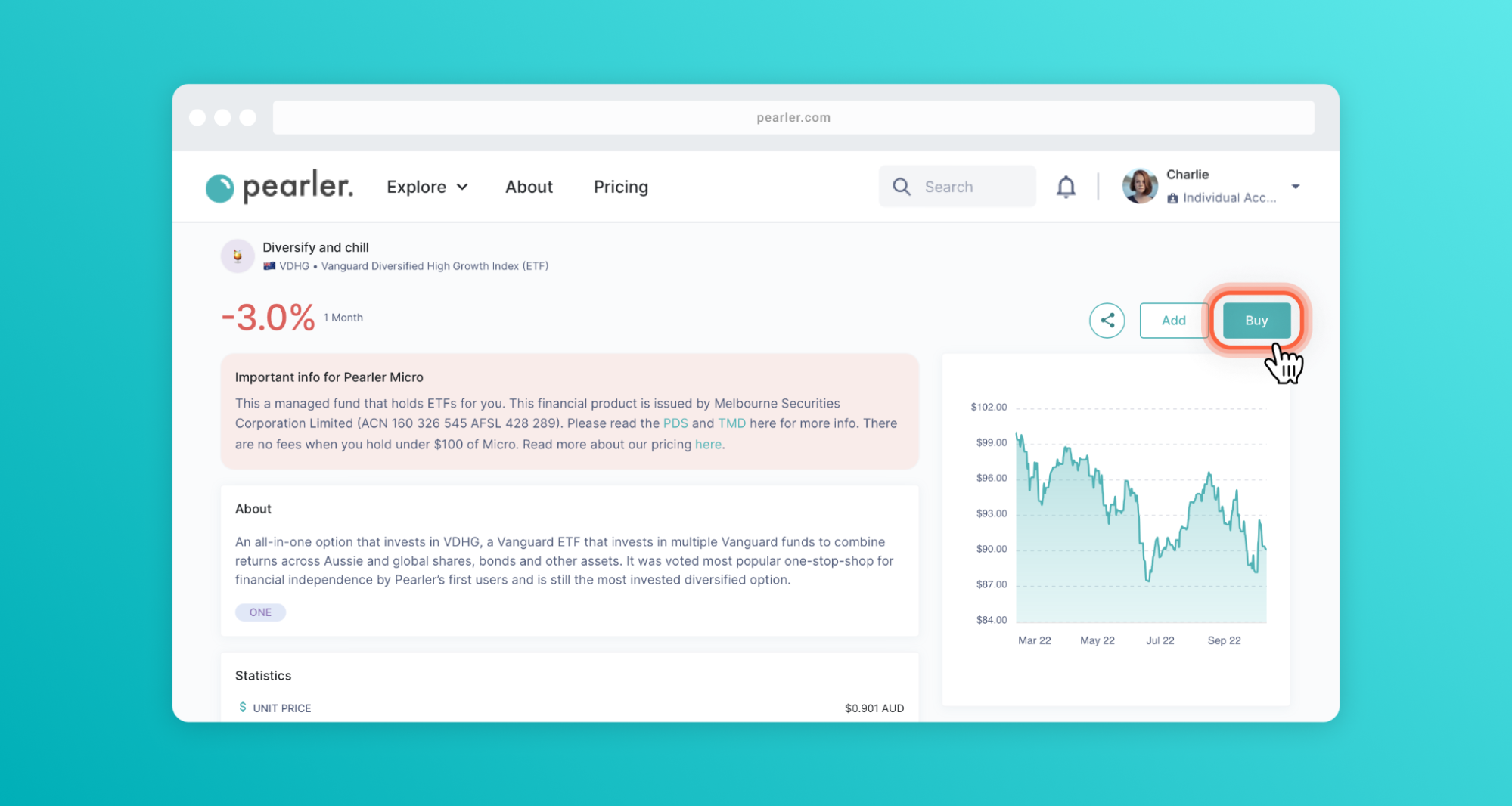

Once you’ve found one that feels like the right choice for you, select “Buy”.

Step 3

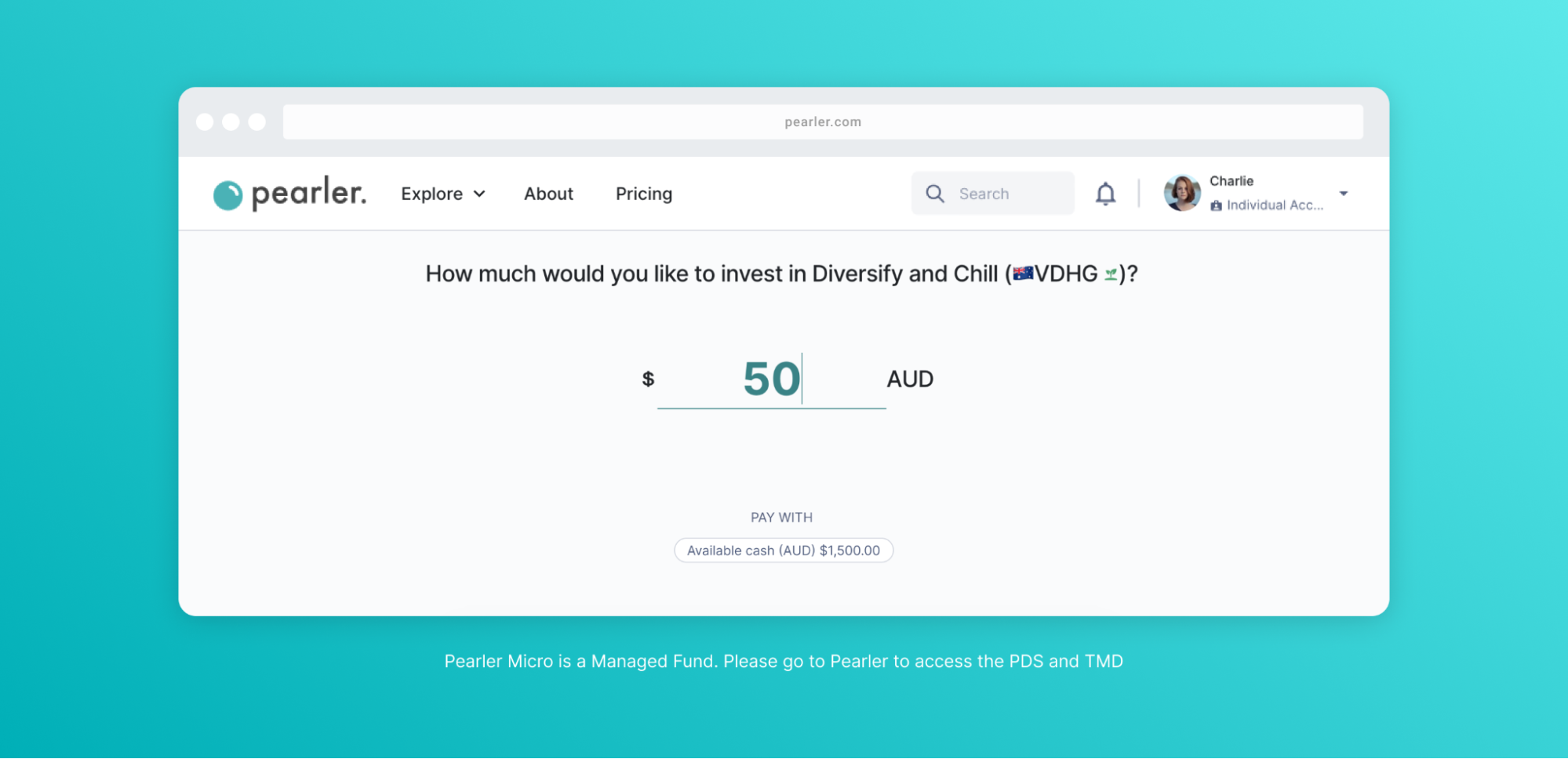

Step 3

Finally, confirm how much you’d like to invest, then you’re all set!

Optional Step

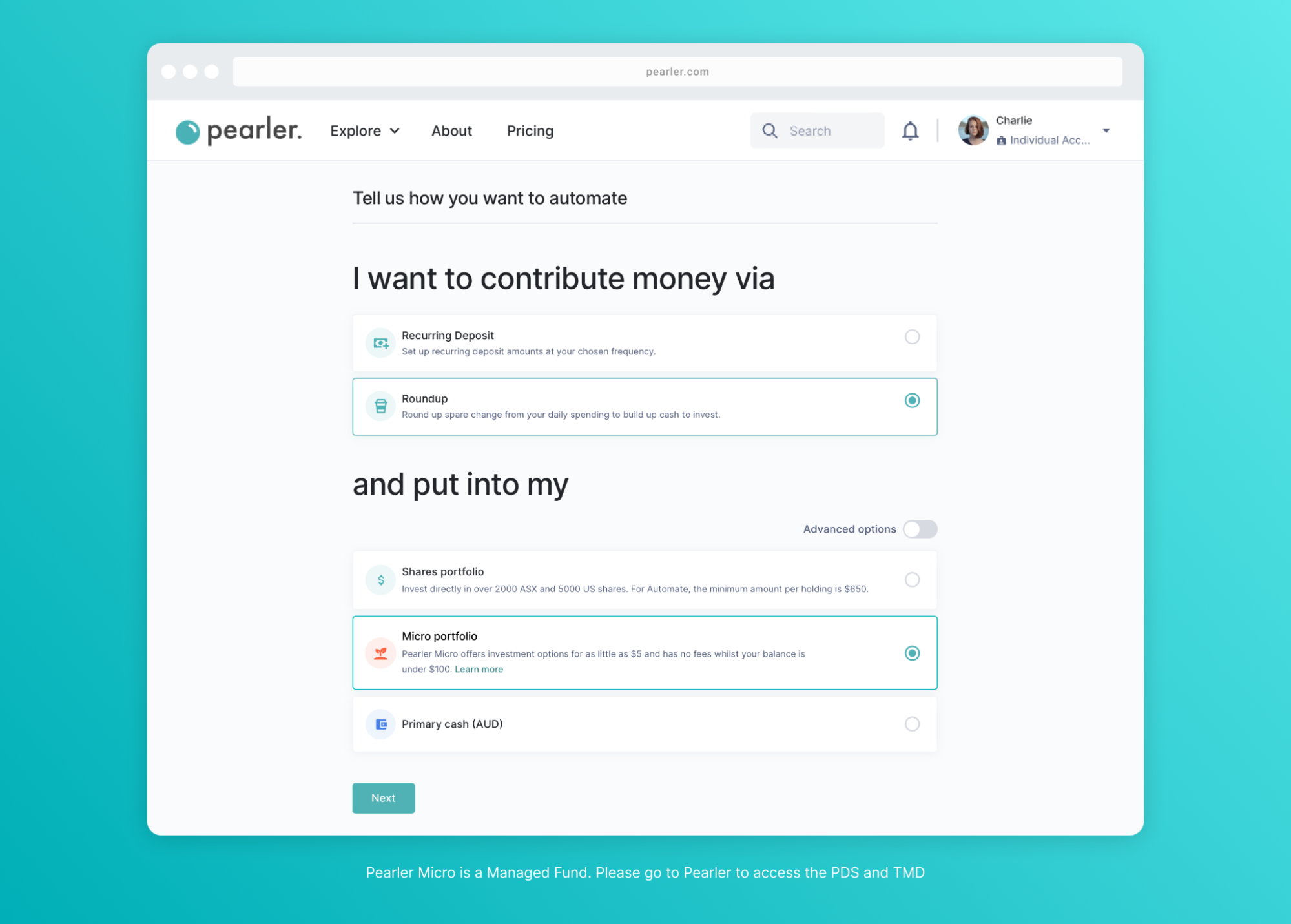

Would you like to set and forget your investing? If so, Pearler’s auto-investing feature, Automate, is perfect for you. With Automate, you can invest via recurring automated deposits from your bank; roundups from your day-to-day spending transactions; or even manual deposits you send from your bank account.

Once you’ve set this up, you’re on autopilot. Congratulations: the hardest part of your journey to becoming a confident long term investor is now complete. Pour yourself a glass of vino - you’ve earned it!

If you’d like to learn more about micro-investing, you can also check out our guide.

Once you’re a seasoned investor

In the future, you may decide you want to own shares directly, rather than only through a micro-investing managed fund. If this happens, you can first dip your toe in the water by opening a shares account. In the example of Pearler, this would involve opening a Pearler Shares account alongside your existing Pearler Micro account. At this stage, you can either decide to leave your existing investments in your micro-investing account, or consolidate them into one shares account.

The great news is: don’t need to decide now. If you DO want to invest, though, it makes sense to get started investing ASAP. When it comes to investing, we ship the idea that time in the market works better than timing the market.

Either way, once you’ve gotten started, you’ll never need to tolerate another mansplaining investment Google result again!

The not-so-fine print

The micro-investing product covered in this article is issued by Melbourne Securities Corporation Limited (ACN 160 326 545 AFSL 428 289). For more information, read the relevant PDS and TMD. This information is general only and does not consider your personal circumstances, financial situation or needs. Before making a financial decision, you should read the PDS and TMD and consider whether the product is right for you. When in doubt, obtain advice from a professional financial adviser.